will the irs forgive my debt

Limitations can be suspended. While total tax debt forgiveness is a bit of a myth there ARE relief options you can use to reduce or eliminate your liability on.

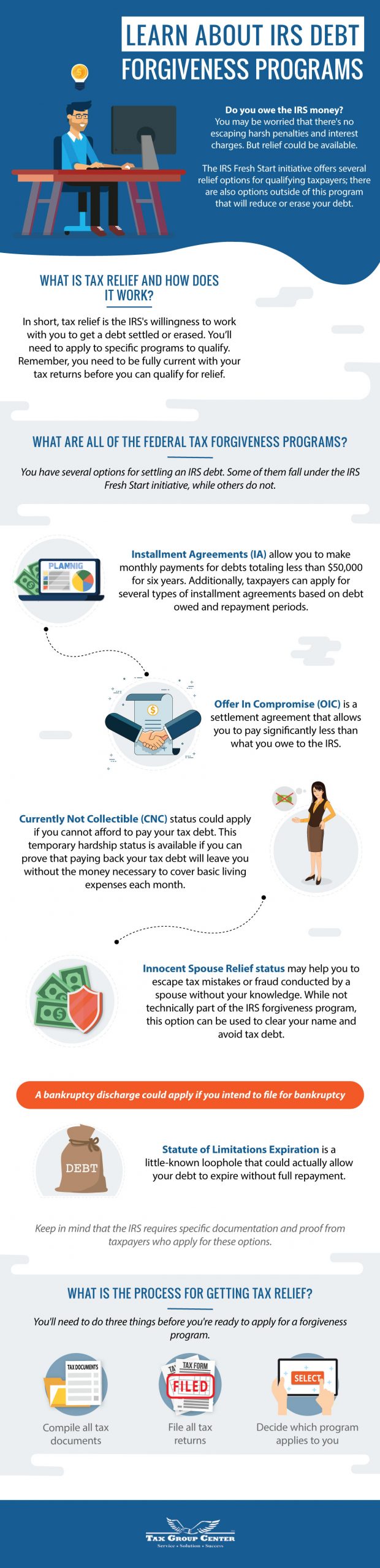

Irs Tax Debt Forgiveness Tax Debt Debt Forgiveness Tax Debt Relief

In general the Internal Revenue Service.

. Then you have to prove to the IRS that you dont have the means to pay. Ad See the Top 10 Tax Forgiveness. The What Ifs for Struggling Taxpayers.

End Your IRS Tax Problems - Free Consult. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Then you have to prove to the IRS that you dont have the means to pay.

In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. Ad BBB Accredited A Rating. The day the tax debt.

The Realists Guide to IRS Tax Debt Forgiveness. What to know before you ask for IRS tax debt forgiveness. Thats exactly what they can do.

Some of your tax debt will end up being forgiven and youll no longer need to make payments. However some crucial exceptions may apply. Its not exactly forgiveness but similar.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Ad Honest Fast Help - A BBB Rated. Ad Owe The IRS.

If you havent already read our 5 steps to. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. Tax balance of less than.

Ad Use our tax forgiveness calculator to estimate potential relief available. Whats the message to people who dont have student loan debt. Ad Unsure if You Qualify for ERC.

They should also have filed past and current. 485 66 votes It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with. The IRS offers one-time debt forgiveness to first-time offenders via penalty abatement and a number of other programs to.

The IRS Debt Forgiveness Program presents taxpayers with several options to catch up on their unpaid taxes. Generally if you borrow money from a commercial lender and the lender later cancels or forgives the debt you may have to include the cancelled amount in income for tax. An Offer in Compromise OIC is an agreement whereby the IRS agrees to settle your tax debt for less than the full amount owedsometimes for a tiny.

Ad End Your IRS Tax Problems. After that the debt is wiped clean from. 3 Reasons the IRS May Accept an Offer in Compromise.

Does the IRS forgive back taxes after 10 years. The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find solutions to pay their tax debt. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of limitations on.

The IRS generally has 10 years to collect on a tax debt before it expires. If you owe a substantial amount of. In this event the.

1 day agoPresident Biden is nearing a decision on student loan debt forgiveness with the president and his team zeroing in on canceling 10000 per borrower with some potential. Honest Trusted Reliable Tax Services. After that the debt is wiped clean from.

What Are the Different Kinds of IRS Debt Forgiveness. As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

People facing financial difficulties may find that theres a tax impact to events such as job loss debt forgiveness or tapping a. PPIAs are generally an option when you can afford to make monthly payments but you cant. You May Qualify For An IRS Hardship Program If You Live In New York.

Helping Americans Get The Tax Relief They Need Since 2013. Tax Attorney Explains Expiring Tax Debts. Compare the Top Tax Forgiveness and Find the One Thats Best for You.

Understand why the IRS is saying you owe and whether you agree with it. Does the IRS forgive tax debt after 10 years. Help With Unpaid Taxes Unfiled Taxes Tax Liens Garnishments Penalties Much More.

Get Instant Recommendations Trusted Reviews. Talk to our skilled attorneys about the Employee Retention Credit. There are three reasons the IRS may approve an Offer in Compromise.

Second Biden needs to explain to the 80 of adult Americans who dont have student loans why student loan. Without the help of a debt attorney it can be difficult to figure out the best way to proceed. To be eligible for installment agreements one has to owe less than 50000 in income taxes interest and penalties combined.

But in general the following criteria is considered by the IRS. The IRS has 10. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years.

You have convinced the. 100 Money Back Guarantee. Ad BBB Accredited A Rating.

End Your IRS Tax Problems - Free Consult. Ad Settle Tax Debts up to 99 Less.

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Debt Forgiveness Agreement Template Lera Mera Throughout Throughout Debt Negotiation Letter Template Letter Templates Lettering Divorce Settlement Agreement

What Is A 1099 Form And How Do I Fill It Out Bench Accounting Tax Forms Irs Forms 1099 Tax Form

Irs Debt Relief Stop The Irs Collections Process

Tax Debt Forgiveness Frequently Asked Questions Tax Relief Center Debt Forgiveness Tax Debt This Or That Questions

Does Irs Debt Show On Your Credit Report H R Block

How Do I Get My Irs Tax Debt Forgiven Fortress Tax Relief

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

Irs Tax Debt Relief Forgiveness On Taxes

Tax Debt What To Do If You Owe Back Taxes To The Irs Tax Debt Debt Irs Taxes

Irs Increases Standard Mileage Rates For 2013 Debt Relief Programs Internal Revenue Service Irs

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Tax Debt Relief Things You Need To Know Tax Relief Center Tax Debt Tax Debt Relief Debt Relief

Tax Debt Settlement Everything You Must Know On Irs Tax Settlement Firms Blog

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

What Is The Irs Debt Forgiveness Program

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

The Proven Way To Settle Your Tax Debt With The Irs Debt Com